When Steve Jobs left Apple in 1985, the company’s once-thriving profit margins took a nosedive. Within a year, Apple found itself on the brink of insolvency, losing over a billion dollars. When Jobs returned, he swiftly turned the company’s fortunes around, implementing a robust management structure and cultural norms that still define Apple today. As another expert put it, Jobs had to “revamp” the company.

The cost of failed CEO succession is simply too great to ignore. We’re talking nearly a trillion dollars annually for the S&P 1500 alone. Yet companies often make critical mistakes in CEO succession planning, from neglecting internal talent to poor assessment methods. This article outlines the seven most common errors and shows how leveraging assessment tools can help avoid them, ensuring a smoother transition and long-term success.

Common mistakes in leadership and CEO succession planning

A poorly managed transition can derail even the most successful organizations, leading to power struggles, loss of strategic direction, and plummeting employee morale. Here are 7 common mistakes that plague CEO succession efforts:

1. Not having a succession plan

One of the most glaring mistakes in CEO succession planning is not having a structured, proactive process in place. The 2023 Gartner Board of Directors Talent Survey revealed that only 51 percent of surveyed directors said their company had a written CEO succession plan. This lack of planning can have dire consequences. Moreover, research proves that effective succession planning leads to improved employee engagement and retention, ultimately driving better firm performance.

Research by McKinsey shows that between 27 and 46 percent of executive transitions are viewed as failures or disappointments after two years. Simply put, it’s not enough to appoint a successor and hope for the best. Many times, even the seemingly perfect candidate can falter due to issues like similarity bias—when individuals favor those who share their own identities or characteristics. This bias can cloud judgment, leading to choices that may not be in the best interest of the organization.

It’s like picking your successor based on who laughs at your jokes the most – charming, but not exactly strategic. Perhaps, a mix of objective evaluation methods and tools might help identify the right candidates while minimizing biases?

Without a structured succession plan, companies risk abrupt leadership changes that can disrupt operations and even erode investor confidence. In contrast, a well-thought-out succession plan ensures a smoother transition, minimizing disruptions and aligning the new CEO’s vision with the company’s long-term goals

2. Overlooking internal talent

While bringing in an outsider can sometimes be the right move, it often comes with significant drawbacks. For instance, external hires cost 18% more than internal hires and are 21% more likely to leave during the first year. Imagine the substantial financial and operational disruptions this can cause.

Industry leader, Ben Fanning, once told a story of a 150-year-old athletic apparel company with a tradition of developing internal talent and promoting from within. Despite the company’s past success, shareholders were concerned about new challenges, leading the company to hire an executive leader from a competitor instead of promoting internally. Soon after, major position changes were implemented, and there were new faces on the executive team.

But it wasn’t long before the collaborative family culture was upended, and revenue began to drop. The company went from a $1.25 billion company in 1995 to eventually being sold to Berkshire Hathaway in 2006 for a mere $600 million.

Focusing too heavily on external candidates can lead to several potential drawbacks. External hires often face steep learning curves and may struggle to understand the company’s culture and internal dynamics. They can also inadvertently disrupt established workflows and relationships, which can hinder productivity and morale.

| Aspect | Internal Talent | External Candidates |

| Familiarity | Knows company culture and operations | Requires time to adapt |

| Loyalty | Often more loyal and committed | May have less loyalty to the company |

| Cost | Generally lower cost of recruitment | Hiring and onboarding can be expensive |

| Adjustment Period | Shorter adjustment period | Longer adjustment period |

| Organizational Fit | Already aligned with company values | Needs to align with company culture |

In contrast, developing and considering internal talent offers significant benefits. Internal candidates are already familiar with the company’s culture, operations, and strategic goals. They have established relationships within the organization and are often more likely to be seen as credible leaders by their colleagues. Additionally, promoting from within can be a powerful motivator for employees at all levels, fostering a culture of loyalty and ambition.

One shining example of successful internal succession is Mastercard’s transition from Ajay Banga to Michael Miebach as CEO. Ajay took the helm in July 2010, and by 2015, the company had already started discussing the next succession. When the time came, they considered more than 40 internal employees.

“We knew that we would find the right CEO among the four internal contenders.” – Richard Haythornthwaite and Ajay Banga, HBR.

Despite initially looking at external candidates, they ultimately didn’t interview any because they trusted their internal contenders. This strategy allowed Mastercard to maintain continuity, preserve its culture, and leverage the institutional knowledge of its leaders.

So, should companies invest more in identifying and grooming internal talent for leadership roles? It’s a question worth pondering, especially considering the potential financial and operational advantages. And keep in mind that research ties 25.4% greater total financial performance to internally promoted CEOs than external hires.

3. Neglecting cultural fit and alignment

A staggering 89% of hiring failures are due to poor cultural fit. When leaders are not aligned with the organization’s values, vision, and desired culture, it can lead to a lack of trust, communication breakdowns, and ultimately, decreased productivity. Employees may feel disengaged and unmotivated, leading to higher turnover rates and lower overall performance.

Say a fast-paced company hires a CEO from a traditional, bureaucratic organization. Despite this new CEO’s impressive track record, their leadership style is likely to clash with the company’s innovative and agile culture. A CEO who aligns with the company’s values and culture is more likely to inspire and motivate employees, leading to higher levels of engagement and performance.

But organizations tend to focus too much on finding the right person for the job, forgetting that finding the right fit for the company’s culture and future direction also matters.

A practical example of this is illustrated by this tweet below from a business leader who emphasizes the value of personality assessments in the workplace:

Using succession planning assessment tools helps organizations understand their leaders and employees better, fostering a culture where everyone can thrive by leveraging their unique strengths.

4. Poor assessment methods

Often, companies fall into the trap of overemphasizing certain testing methods while neglecting others that are equally critical. Here are some common pitfalls:

- Overreliance on interviews: Interviews can be subjective and influenced by biases, leading to a skewed understanding of a candidate’s capabilities.

- Neglecting objective assessment tools: Without standardized tools, it’s challenging to measure candidates consistently and accurately.

- Lack of job analysis: Failing to thoroughly analyze the role can result in selecting a candidate who may not meet the specific demands of the position.

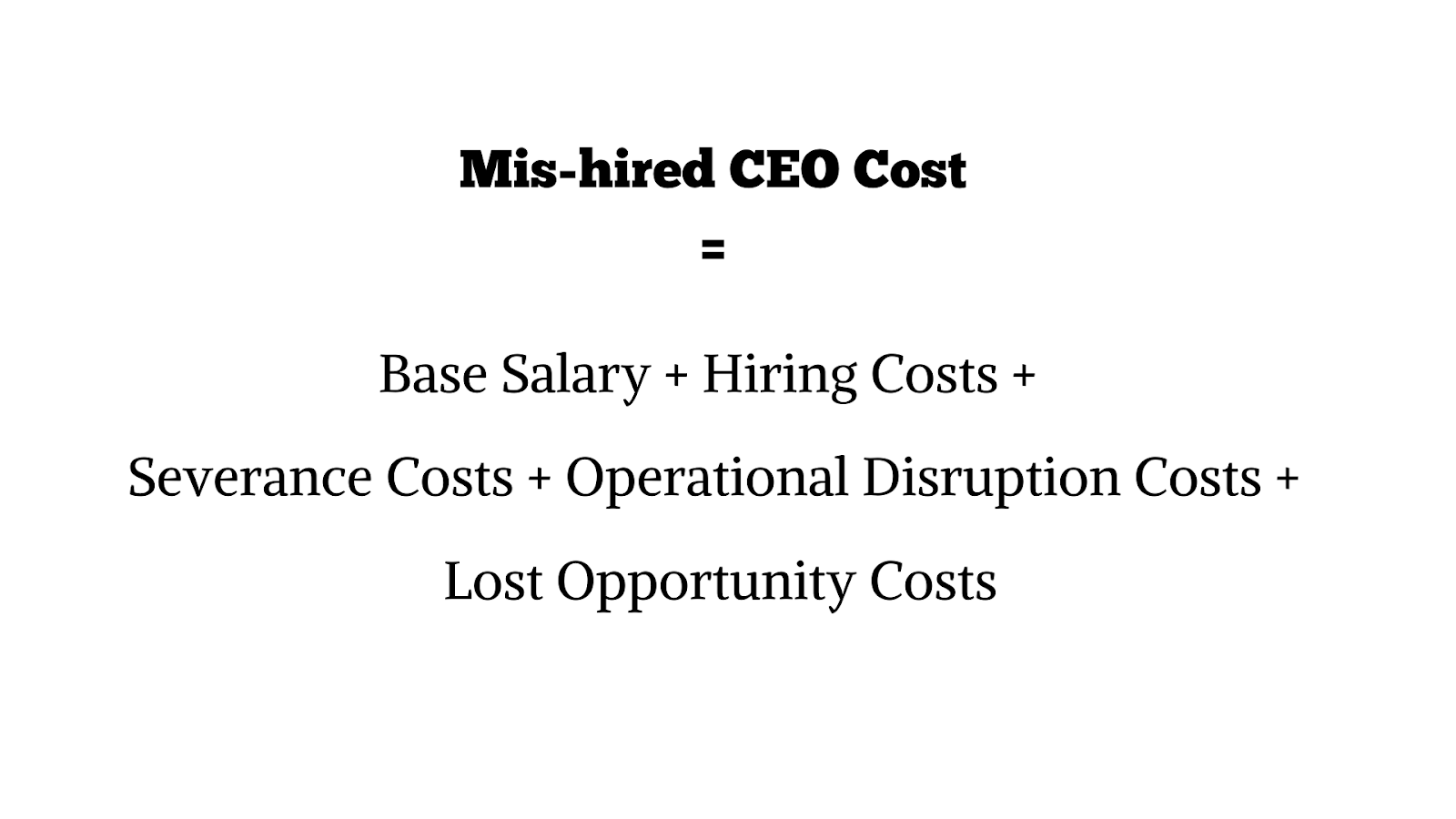

Experts agree that the cost of a mis-hired CEO can be as high as 27 times their base salary. This wild figure arises because a new CEO often brings in their own trusted leadership team, causing significant disruptions and costs within the organization.

See why it is important to get it right from the start?

To mitigate these risks, consider incorporating robust assessment tools for succession planning. These tools provide objective evaluations of potential candidates, ensuring decisions are based on data. Talent assessment tools help identify leaders who align with the company’s strategic goals and culture, promoting continuity and stability while saving costs.

5. Underestimating stakeholder engagement

Failing to adequately involve stakeholders can lead to misalignment and resistance, as dramatized in Hollywood’s 1986 film, “Gung Ho.” In the movie, the job of implementing a new work culture at a car manufacturing plant falls upon Michael Keaton’s character.

Initially, his attempts fail completely. It isn’t until they figure out a way to bridge cultural gaps and incorporate employees’ suggestions and ideas into their processes that things turn around.

Of course, real life is often not as forgiving, and failing to secure stakeholder buy-in can sink a business. Lack of support for a new CEO, whether that’s from department heads or frontline employees, undermines their ability to lead effectively.

6. Inadequate onboarding and transition processes

Even with a well-executed succession plan, organizations often falter in the final stages by neglecting a thorough onboarding and transition process for the new CEO. Case in point: Disney’s rocky leadership transition in 2015.

The company announced Tom Staggs as the chief operating officer, positioning him to succeed CEO Bob Iger in 2018. However, just a year later, the plan unraveled, with Staggs leaving the company and the board expanding its search for Iger’s successor. Reports cited various reasons for the fallout, including doubts about Staggs’ leadership skills and reservations from Iger himself.

The lesson here is clear: even with a seemingly well-structured plan, inadequate management of the transition can lead to chaos. Many organizations make the mistake of assuming that simply appointing a successor is enough. In reality, effective CEO succession planning assessment should encompass a detailed and supportive onboarding process.

Understanding that most executives have strengths and weaknesses is key. While some may excel strategically, others might shine operationally or organizationally. The goal isn’t to find a perfectly balanced individual but to create a balanced team that can support the new leader’s growth and address any gaps.

With reliable assessment for CEO succession, you gain insights into candidates’ strengths and weaknesses, enabling them to build complementary leadership teams. For instance, a CEO strong in strategic vision may benefit from a COO with exceptional organizational skills.

Moreover, a robust onboarding process ensures that the new CEO has the support and resources needed to succeed from day one. This includes providing clarity on expectations, facilitating introductions to key stakeholders, and offering ongoing mentorship and coaching.

7. Overlooking external factors

While much of the focus in CEO succession planning is understandably on internal factors, organizations often overlook broader external trends and market forces that can impact the skills and attributes required in their next leader.

- One of the most significant external factors impacting CEO succession is industry disruption. As industries evolve and new technologies emerge, the skills and expertise required of a CEO can change dramatically. For example, digital tech has changed the retail world, requiring CEOs to possess a deep understanding of e-commerce and data analytics.

- Technological shifts are another external factor that can’t be ignored. From artificial intelligence to blockchain, new technologies are reshaping business models and customer expectations. CEOs who fail to grasp these technologies and their implications may find themselves leading companies that are left behind.

- Regulatory changes are also a key consideration in CEO succession planning. Industries like healthcare and finance are subject to complex regulatory environments that can have a significant impact on business strategy. A CEO who is not attuned to these regulatory shifts may struggle to lead effectively.

- Lastly, evolving customer demands must be taken into account. As consumer preferences change, CEOs must be able to anticipate and respond to these shifts. A CEO who is out of touch with customer needs risks alienating their customer base and losing market share.

Organizations must look beyond their own walls and consider the broader external forces shaping their industries. This helps them select a leader equipped to see them through the challenges and opportunities.

How the right tools can help you hire the right CEO

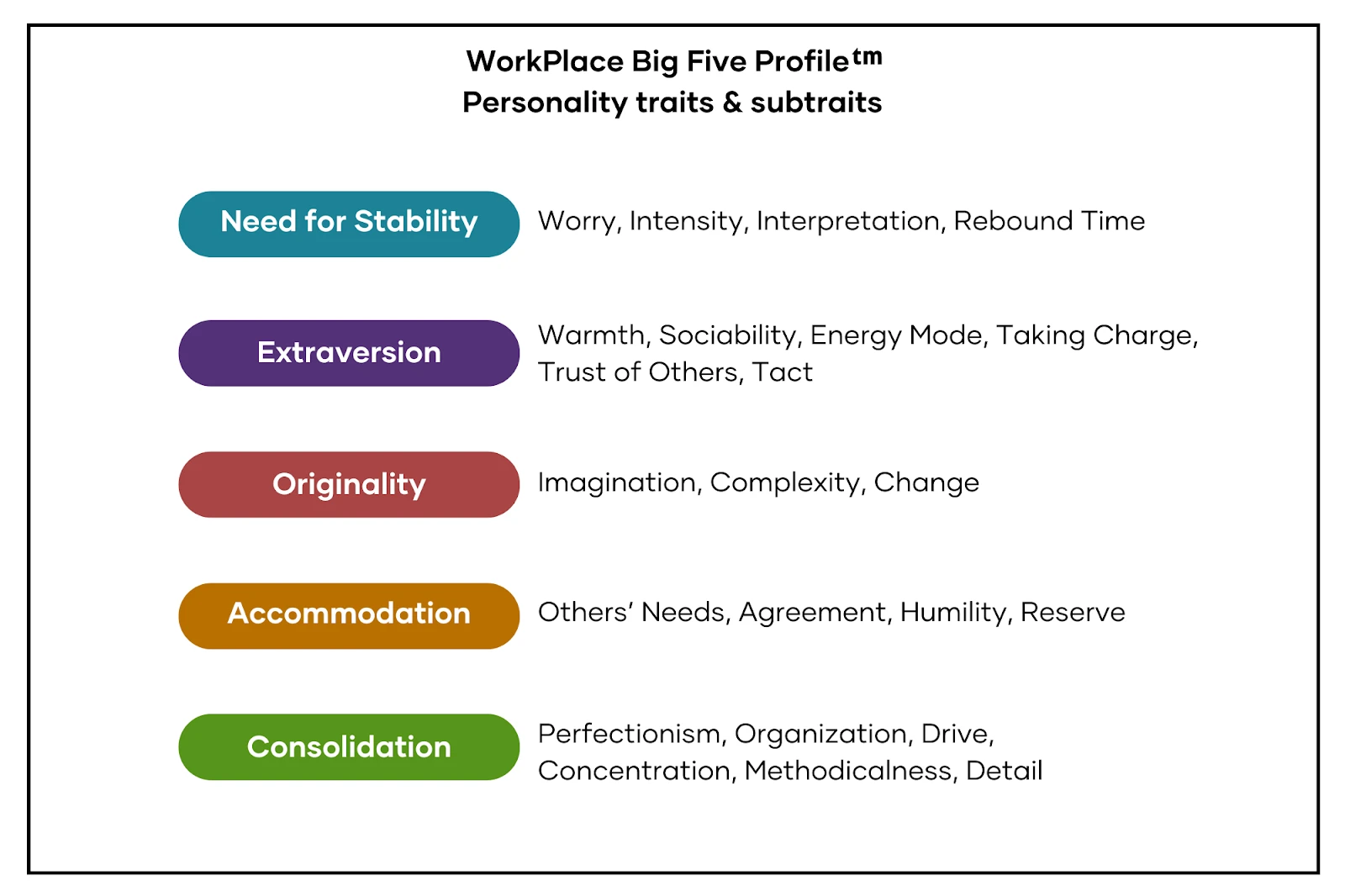

While these common mistakes mentioned above can derail even the most well-intentioned succession efforts, you can reduce these risks by leveraging scientifically validated assessment tools, such as the Workplace Big Five assessment inventory.

Based on the widely accepted Five-Factor Model of personality, this comprehensive assessment provides deep insights into candidates’ personalities, work styles, motivations, and potential fit for the CEO role – insights that can inform more strategic, data-driven decisions throughout the succession process.

Identifying high-potential candidates

One of the primary roles of assessment tools in CEO succession planning is to identify high-potential candidates within the organization. These tools use several assessment methods, such as psychometric tests, competency-based interviews, and 360-degree feedback, to evaluate candidates’ leadership capabilities, problem-solving skills, and ability to drive results.

Warren Buffett famously outlined three key qualities he looks for when hiring people: intelligence, initiative, and integrity.

Business succession assessments can help organizations gauge these qualities in potential CEO candidates. For example, personality assessments can provide insights into a candidate’s character traits, such as their level of conscientiousness and integrity. Cognitive assessments can measure a candidate’s intelligence and problem-solving abilities.

Assessment tools help in identifying candidates with the right leadership style for the organization. Different leadership styles are effective in different contexts, so you should match the candidate’s style with your organization’s culture and strategic goals.

| Aspect | Ineffective Methods | Effective Methods |

| Evaluation Approach | Overreliance on interviews | Incorporating a mix of interviews, simulations, and assessments |

| Objectivity | Subjective judgments | Data-driven insights from validated assessment tools |

| Scope | Focusing solely on past performance | Evaluating future potential and leadership capabilities |

| Tools | Generic personality tests | Using specialized tools like the Workplace Big Five assessment |

| Stakeholder Input | Limited involvement of key stakeholders | Engaging board members and senior leaders in the assessment process |

| Cultural Fit | Neglecting alignment with company values and culture | Assessing cultural alignment and organizational fit |

Assessing CEO-specific competencies

While developing internal talent is often a wise strategy, there are times when an organization’s unique circumstances call for an outside perspective – someone who can identify blind spots, challenge long-held assumptions, and propel the company in a new strategic direction. Experts have even been able to prove before that CEOs recruited from outside can perform better, under circumstances.

However, successfully integrating an external hire, especially at the CEO level, requires a deep understanding of how their personality, leadership style, and problem-solving approach will mesh with the organization’s culture and needs.

This is where the Workplace Big Five assessment shines.

By evaluating traits like Originality, also known in the Big Five as openness to experience, which is linked to strategic thinking and adaptability, the assessment can provide insights into a candidate’s ability to identify underlying issues and bottlenecks that may be invisible to those immersed in the company’s day-to-day operations.

Take, for example, the case of William Perez, who was brought in as an external hire to succeed Nike’s founder, Philip Knight, as CEO in 2004. While Perez had a successful track record at his previous company, S.C. Johnson & Son, his alleged analytical, process-focused management style ultimately clashed with Nike’s more creative, brand-driven culture, leading to his resignation after just 13 months.

Had Nike leveraged a tool like the Workplace Big Five during the hiring process, they might have identified this potential mismatch earlier on, allowing them to either adjust their expectations or consider candidates whose personalities and problem-solving approaches better aligned with the company’s needs.

For instance, a candidate who scores highly on traits like curiosity and openness to experience may be better equipped to challenge long-held assumptions and uncover underlying root causes that others have overlooked. Conversely, a candidate with high conscientiousness might excel at implementing structured, process-driven solutions once the core issues have been identified.

Evaluating cultural fit and alignment

The fit between a CEO’s personality and organizational culture is a significant predictor of firm performance. A prime example is the case of a renowned bank known for its exemplary management and strategic acquisitions. The CEO and head of retail banking were hailed as top performers.

Despite its strong reputation, the bank faced a scandal involving employees opening unauthorized accounts to meet aggressive sales targets. Over five years, millions of fake accounts were created without customer approval, leading to a $185 million settlement and a significant drop in stock price. This financial penalty was substantial but the reputational damage far greater.

The CEO faced one of the largest clawbacks ever for a bank executive, forfeiting tens of millions in compensation, and ultimately resigned under a cloud of controversy.

This shows how mismatched values at the top can enable unethical behavior throughout an organization. The most lauded leaders still need to walk the talk on ethics and culture. Perhaps, a thorough assessment could have caught that disconnect early on?

CEO succession planning tips

Remember the Mastercard from earlier? We can glean valuable lessons for organizations looking to enhance their succession planning efforts.

Starting the succession process early

One of the key takeaways from Mastercard’s CEO succession story is the importance of starting the succession process early. By initiating the process well in advance, you have ample time to identify and develop potential successors, reducing the risk of disruptions when a leadership change becomes necessary.

Involving the entire board

Mastercard’s succession process involved the entire board and this shows the importance of collective decision-making and alignment among board members. This cohesive approach ensures that all stakeholders are on the same page and reduces the likelihood of conflicts or disagreements during the succession process.

Seeking outside help

Mastercard wasn’t afraid to seek outside help to improve their succession process. By enlisting the support of advisors, they were able to implement SEO succession planning best practices, such as immersive training, development plans, and psychometric testing, to evaluate potential successors objectively. This external perspective provides valuable insights and ensures the succession process is thorough and effective.

And while there’s bound to be some disappointment among those not chosen, Mastercard’s inclusive process and commitment to stakeholder engagement paid dividends in the end. By fostering a shared understanding and buy-in from the outset, the board was able to move forward as a unified team, rallying behind the new CEO and positioning the company for continued success.

Where do you go from here?

It’s clear by now that effective CEO succession planning is about fostering a collaborative, data-driven process that builds up to the right outcome.

Of course, this level of coordination and alignment doesn’t happen by accident. It requires a willingness to plug knowledge gaps, a commitment to leveraging appropriate tools, and a recognition that CEO succession is a team effort – one that demands the engagement of those charged with safeguarding the organization’s future.

Bringing in outside help to implement a CEO success planning and assessment strategy is a great way to sidestep a lot of internal obstacles and biases.

Ready to drive long-term organizational success? Let’s chat!